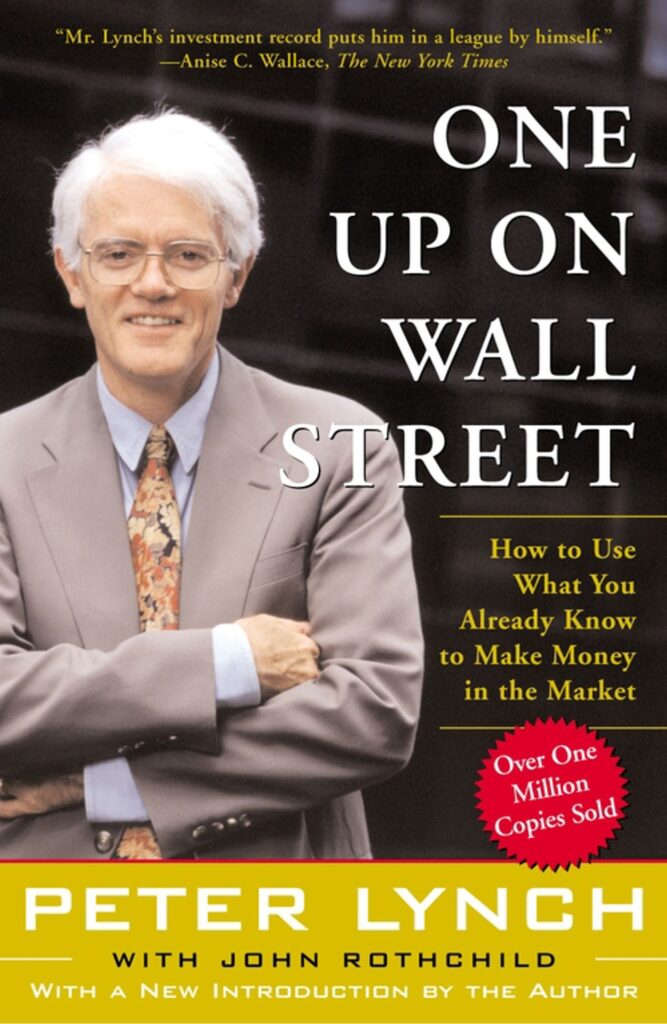

Peter Lynch wrote one up Wall Street. Peter Lynch was born on January 19, 1944, and is an American investor, mutual fund manager, and philanthropist. He has also authored many books and papers on investing and has compiled many well-known mantras for modern investment strategies, such as investing in the know-how and ten baggers. Lynch is often described as “mythical” by the financial media for his record of operations and was cited as “a myth” by Jason Zweig.

In his the revival of Benjamin Graham’s 2003 book, The Intelligent Investor. The book one up on Wall Street is very popular in personal investment books. For one thing, seeing Lynch paint Wall Street with his team of investors is fantastic. He is a leading salary manager in North America. His success is due to Fidelity’s Magellan Fund. This is a modern version of the dates of the content in the pre-1989 period. Warning for new investors:

Lynch is a graduate of Wharton. She has worked in the market since her graduation days. As such, he sees stocks as straightforward and simple. Like Warren Buffett, he is a regular investor who finds neglected firms in the fields of nuts and bolts. However, when Warren bought the companies, Lynch bought shares of those companies. One Up on Wall Street is highly recommended for people who manage their portfolios.

There is something interesting about Peter Lynch’s approach. He takes the view that middle-class (amateur) investors can beat professionals by using common sense and self-control. While investing is always a gamble, a discerning investor can find companies that put the conflict right to succeed. This is a lovely book written by a very polite and engaging character, full of beautiful anecdotes and sound advice. It has a place in my top twenty investment books.